As the CEO of a mortgage lending company, picture yourself entrusted with overseeing the minute intricacies of mortgage operations. Among the many responsibilities of your job, processing mortgages is a challenging and time-consuming process that’s the last thing you want to manage.

What if a team of experts could be tasked with doing the preliminary work?

It will save time as well as resources. If your internal team doesn’t have to deal with the mountains of paperwork associated with property appraisals, loan processing, underwriting, and mortgage servicing, they can focus on creating new products, cultivating relationships with clients, and much more. Profits are impacted by mortgage processing outsourcing services, there’s no doubt about that.According to a Deloitte analysis, 80% of the world’s leading financial institutions have outsourced a significant portion of their mortgage operations, which has allowed them to save up to 50% on costs.For businesses seeking to streamline their mortgage operations through effective outsourcing solutions, this figure makes a compelling case. Having said that, let us look at the global trends that will influence the outsourcing of the mortgage process going forward.We’ll also look at its advantages, applications, and breadth of usage to support you in making informed business decisions.

The Global Mortgage Business Process Outsourcing Services Trend

Lenders all over the world have started utilizing the possibilities of outsourcing the mortgage process in recent years. The practice of mortgage lenders choosing to outsource mortgage processing services has seen a notable surge in popularity. The global mortgage lending market is expected to increase at a CAGR of 9.5% from 2022 to 2031, reaching $27,509.24 billion, according to a report by Allied Market Research.

Why Select a Firm to Handle Home Equity Loans?

There are various advantages to hiring a specialized business to handle your mortgage processing assistance needs. These businesses employ industry specialists that guarantee adherence to current laws and offer a variety of services, such as assistance with loan application processing, document gathering and authentication, and post-closing support. These businesses assist lenders in enhancing their business processes and client satisfaction by putting a strong emphasis on compliance, accuracy, customer service, and fast response times. Additionally, these businesses offer round-the-clock assistance, guaranteeing more efficient operations as well as improved client relations and support.

The Advantages of Hiring Outside Help for Your Mortgage Processing

Outsourcing mortgage processing has several advantages, especially for mid-sized lenders. The best approach to handle mortgage operations accurately and professionally is through outsourcing, as small businesses usually lack the sophisticated resources available to larger ones. It eliminates the need to select, develop, and manage an internal team. Lenders can focus on expanding their market share, funding strategic expansion initiatives, and enhancing the borrower experience overall by offering value-added services. Outsourcing provides access to the newest digital technology and big data analytics, enabling better decision-making. With a more efficient process and knowledgeable processors, lenders can ensure faster loan processing times. Furthermore, risk management services are provided by outsourcing companies, helping lenders comply with regulatory standards.

Crucial Considerations for Choosing a Service Provider

It’s important to consider a number of things before selecting an outsourcing partner. These consist of their service offering, standing, customer service, response speed, technological aptitude, accessibility and communication, cost and scalability, and compliance with regulations. Lenders can choose a service provider that fulfills specific needs by taking these criteria into account.

Cost Increase

There’s good news if you’re in the market to buy a property. Zillow forecasts indicate that the growth in property values in 2021 has consistently surpassed previous benchmarks. This has occurred in other local marketplaces in addition to the national market. Low mortgage interest rates, which result in record low prices, and COVID-19 are to blame for this growth. The difference between buyers and sellers in 2022 will be smaller than it was in 2018. Why? Simple supply and demand govern this. There weren’t enough houses available in 2018 to meet the demands of purchasers. Significant price growth resulted from this. We anticipate that in 2022, as more listings hit the market, there will be less competition for each property, which will lead to a stabilization or a slight decline in sales prices. It may get easier to buy a new house as selling one gets more convenient for people!

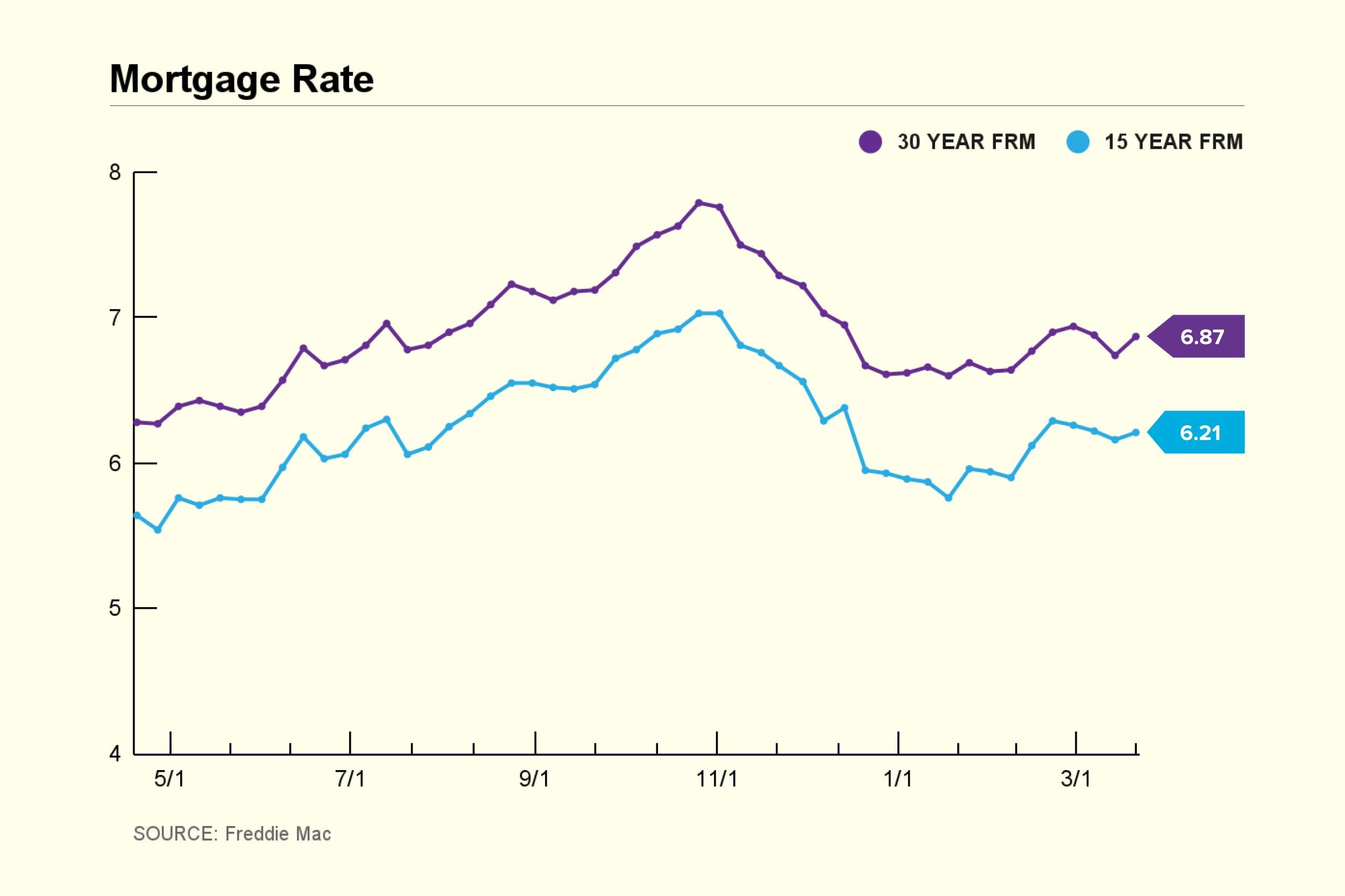

Mortgage Interest Rates

When purchasing a property, mortgage interest is the most important consideration. The fact that mortgage interest rates are at an all-time low right now is wonderful news. Customers can now afford a larger number of homes than they could have with a mortgage with a higher interest rate. Better offers are also being offered by mortgage lenders. Thanks to tax subsidies, low mortgage interest rates, and the present low cost of properties, purchasers can buy homes without breaking the bank. But because real estate markets are cyclical, there will be an increase in mortgage interest rates this year (2022). Prices and sales volume are likely to be impacted when that occurs.

In brief

Outsourcing mortgage processing services not only reduces administrative expenses but also fosters growth by allowing lenders to focus on critical business goals. Mortgage lenders would seem to benefit more from outsourcing given the advantages of knowledge, improved borrower experience, access to cutting edge technology, and financial efficacy. Lenders now have an obligation to stay abreast of these developments as the mortgage industry expands, adapts, and innovates. By opting to use mortgage process automation technologies, lenders can expedite the loan application process, lower mistake rates, and minimize manual intervention. You may significantly enhance your mortgage operations and boost your adaptability to market fluctuations by putting technology to use.

Choosing the Right Outsourcing Partner to Provide Support Services for Mortgage Processing

Our devoted team of mortgage processing specialists has worked with many lenders, so we have a great deal of expertise providing accurate, safe, and affordable mortgage processing solutions that are customized to meet your unique requirements. We have the experience to assist you optimize your processes and concentrate on your main business, whether you need to outsource residential mortgage loan processing support services or refurbishment mortgage loan processing services. Are you prepared to revolutionize your mortgage operations in collaboration with a strategic partner who shares your goals? Give us your mortgage closing support services as an outsourcing project, and see how your business operations change.

FAQs:

What is the nature of MORTGAGE process outsourcing?

The practice of assigning a company’s mortgage processing responsibilities to an outside organization is known as mortgage process outsourcing, or MPO. Loan processing, underwriting, closing, post-closure, appraisal, and title ordering are among the services it covers.

Why would a company decide to contract out the mortgage procedure?

A business may think about MPO in order to take use of experience, lower operating expenses, boost productivity, and stay in compliance with regulations. By outsourcing the complex aspects of mortgage processing, the company is able to concentrate on its core business operations.

Which services are frequently covered by the mortgage process outsourcing?

Loan processing, underwriting, closing, post-closure, ordering appraisals, obtaining titles, and even loan revisions are typical services covered by MPO.

In what ways does outsourcing the mortgage process increase productivity?

MPO increases productivity by expediting the loan application procedure. With its specific knowledge and equipment, the outsourced firm can complete the duties more quickly and accurately. It facilitates faster processing of loans, lowers error rates, and increases volume of loans completed.

Is it feasible to outsource the mortgage application process?

In general, MPO is secure. Reputable outsourcing companies adhere to security guidelines and rules in the mortgage sector. To safeguard sensitive information, they make use of safe platforms and technology.

What part does outsourcing the mortgage process have in keeping the law abiding?

Experts in their industry, outsourcing agencies keep abreast of changes in cross-border regulations. They guarantee that all tasks related to mortgage processing comply with regulations, hence mitigating the risk of non-compliance for the organization.

Is it feasible to suit specific needs by tailoring the outsourced mortgage process?

Yes, MPO services are adaptable and may be streamlined to fit the particular requirements of each lender, taking into account software systems, legal requirements, and different loan kinds.

What are the possible disadvantages of outsourcing the mortgage process?

Loss of control over the mortgage process, dependence on the outsourcing company, probable security threats, and communication problems resulting from time zone differences or language hurdles are some possible drawbacks of MPO.

Is outsourcing the mortgage process beneficial for small and mid-sized lenders?

Yes, MPO has advantages for small and medium-sized lenders. It can assist them in managing higher loan volumes without adding more internal employees. Additionally, it enables them to compete with bigger lenders by offering effective and superior services.