Select breaks down the mortgage application process and looks at what your monthly payments actually cover.

A customer obtains a mortgage when they purchase a property, and they then commit to repaying the loan in small, equal monthly amounts over a predetermined length of time. For many buyers, the mortgage process is an essential part of becoming a homeowner, even though it might be overwhelming the first time. This is all the information you require to comprehend mortgage operations and the real coverage provided by your monthly payment.

When is the right time to get a mortgage if you desire one?

Put another way, when a person wants to buy a house but cannot afford to pay for it all at once, they should apply for a mortgage. Think about this: You most likely won’t want to pay the full sum in cash at once if you’re seeking to buy a house. There are two ways to avoid that huge one-time expense: putting down payment money, or a portion of the home’s value, and getting a bank loan to cover the remaining amount. In exchange for having to repay the money you’re borrowing from the bank (your mortgage), you are free to reside in the property and make any improvements you like.

How should a mortgage application be submitted?

Prior to filing a mortgage application, you should become ready. Firstly, verify that your credit score is as high as it can be by verifying it and ensuring that your credit report is free of any inaccuracies that might be affecting it. Both of these will be examined by mortgage lenders in order to determine your future interest rate. Because a lower interest rate is associated with a higher credit score, you will pay less each month for your mortgage.

Borrowers Can Apply For Jumbo Loans

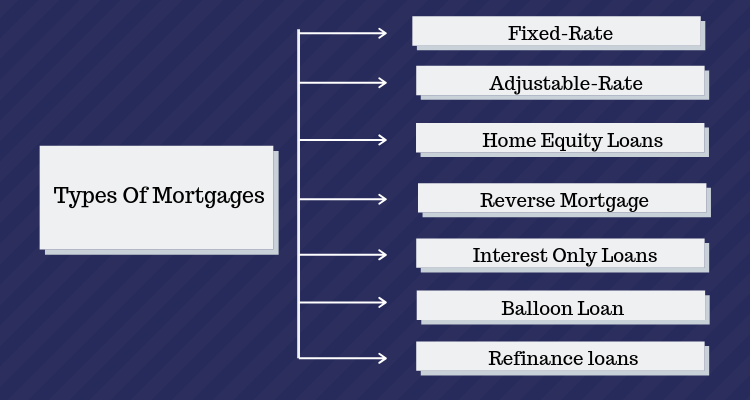

Free access to your credit report and score is provided by Experian. If it is determined that your credit score is low, you might want to take advantage of a service such as *Experian BoostTM. By connecting to your bank account, this specific program checks your transactions for regular utility and subscription service payments. After then, you can use the activity to improve your FICO® Score. Once you are confident that your credit score is sufficient, you should think about the type of mortgage you would like to apply for. Conventional mortgages are the most common kind, usually requiring only a 3% down payment. It may not always be the greatest option for a buyer, though, because of the strict requirements surrounding the debt-to-income ratio for this type of mortgage. A buyer can afford a higher debt-to-income ratio with Federal Housing Administration (FHA) loans because only a 3.5% down payment is required. Borrowers who need to borrow more than $726,200 can apply for jumbo loans. Note that this represents the conforming loan ceiling for 2023; restrictions, however, are subject to change every year and may differ depending on the kind of property in question or the cost of housing in the area. USDA (United States Department of Agriculture) loans are designed for people who want to purchase a home in a rural area and allow them to do so with no down payment. Veterans and their spouses are the target audience for Veterans Affairs, or VA, loans.

Monthly Payments Would Be Required for a Mortgage

It can be helpful to know the precise loan terms you’re looking for. Most lenders provide terms ranging from 10 to 30 years, with 15- and 30-year mortgages being the most common. For fifteen years, a fifteen-year mortgage would require monthly payments, during which the home would have been paid off. Furthermore, if you went with a 30-year mortgage, you would have 30 years to pay it off, whereas a 10-year mortgage would take 10 years. The longer your term, the less your monthly payment will be, but the interest you will pay will increase with time. Find the best mortgage lenders once you’ve determined the kind of mortgage you want and the amount of time you want to fall behind on payments. They are numerous, and many of them offer special advantages. For instance, SoFi offers a variety of ways to cut costs. If you’re already a member, you can get $500 off your mortgage loan. You can also sign up for free and receive a 0.25% interest rate reduction when you lock in a 30-year rate for a standard loan. Furthermore, PNC Bank offers a special lending option to licensed medical professionals who wish to buy a house. This option allows qualified candidates to apply for loans up to $1 million while waiving the requirement for private mortgage insurance.

Simple Mortgage

When the mortgagor personally agrees to pay the mortgage-money without giving up possession of the mortgaged property and agrees, either explicitly or implicitly, that should he fail to make payments as per the terms of the agreement, the mortgagee will have the right to cause the mortgaged property to be sold, with the proceeds of the sale being applied, as needed, toward payment of the mortgage-money, the transaction is known as a simple mortgage, and the mortgagee is referred to as a simple mortgagee.

Mortgage for Conditional Sales

If the mortgagee states that the property will be sold under mortgage:

Under the following terms: either the buyer transfers the property to the seller upon completion of the payment, or the sale becomes final upon the non-payment of the mortgage funds by a certain date; or the transaction becomes null and void upon the completion of the payment; The transaction is called a mortgage by conditional sale, and the mortgagee is referred to as a mortgagee by conditional sale: No such transaction will be deemed a mortgage as long as the condition that impacts or appears to impact the sale is not contained in the instrument.

Utilization-Based Mortgage

The transaction is known as a usufructuary mortgage and the mortgagee is a usufructuary mortgagee when the mortgagor gives the mortgagee possession of the mortgaged property, or explicitly or implicitly commits himself to doing so, and permits the mortgagee to keep possession of the property until the mortgage funds are paid. Additionally, the mortgagor may receive all or a portion of the rents and profits from the property and designate them partially in lieu of interest and partially in payment of the mortgage funds.

English House Loan

In an English mortgage, the mortgagor transfers all of the mortgaged property to the mortgagee and agrees to repay the mortgage funds on a predetermined date. The mortgagee then transfers the property back to the mortgagor once the agreed-upon amount of money has been paid.

Unusual Mortgage

Any mortgage that is not classified as a simple mortgage, mortgage by conditional sale, usufructuary mortgage, English mortgage, or mortgage by deposit of title papers as specified by section 58 is considered an anomalous mortgage..

A Discount Rate Mortgage: Advantages and Cons

The main attraction of a discount rate mortgage is that the interest rate is usually lower than fixed rates, however it’s not always the case. A fixed-rate mortgage has an upfront cost, but it gives borrowers the certainty of knowing exactly how much they will be responsible for paying back each month. If you can find a discount mortgage with a lower rate than a fixed mortgage, you will save money on your first repayments. Compared to other mortgage types, a discount rate mortgage is associated with a greater degree of unpredictability. If you have a tracker mortgage, for example, your rate will adjust in response to changes in the base bank rate set by the Bank of England. If you have a discount rate, though, be aware that lenders have the right to amend their SVRs at any time, so your rate could vary.

which would mean paying a higher monthly fee.

The amplitude of rate fluctuations is just as significant as their frequency. It is possible for a lender to elect to boost their SVR significantly, in which case the monthly rate would increase. Moreover, discount rate mortgages (ERCs) are sometimes linked to early repayment penalties. Even if you choose to refinance into a different arrangement, you will still need to pay this fee if you want to pay off your mortgage early. Since an ERC is calculated as a percentage of the amount being repaid, it might be in the hundreds of pounds. Therefore, if you sign up for a discounted rate mortgage and find that the interest rate is rising over a level you are comfortable with, moving to a different product could end up costing you a lot of money.