A mortgage broker is a middleman who connects lenders and borrowers for mortgages; they do not fund the origination of the mortgages themselves. A mortgage broker facilitates communication between borrowers and lenders and finds the ideal lender for the borrower’s demands regarding interest rates and financial status. They carry out …

Read More »An explanation of mortgages with standard variable rates

You may be moved to a standard variable rate, or SVR, which is an interest rate set by your mortgage provider, once your fixed, tracker, or discount rate mortgage agreement ends. If you would like not to switch to a standard variable rate mortgage, you will have to remortgage with …

Read More »Federal Housing Administration (FHA) Loans

A loan from the Federal Housing Administration (FHA): The government insures a home mortgage granted by a bank or other lender that has received approval from the Federal Housing Administration (FHA). FHA loans allow for a smaller minimum down payment than many conventional loans, and they also allow for applicants with lower credit scores than are usually …

Read More »How to handle the turmoil caused by UK withdrawals from accords and rising mortgage rates

Without any assistance from the budget to lessen the pain, purchasers must try to negotiate their way into an affordable deal. According to an official estimate made last week, the average mortgage rate that UK homeowners pay would increase gradually over the following three years and peak at 4.2% in …

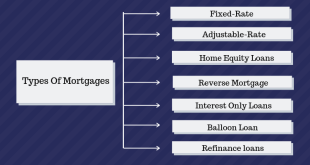

Read More »Sorted: The many types of mortgages and how they work

Select breaks down the mortgage application process and looks at what your monthly payments actually cover. A customer obtains a mortgage when they purchase a property, and they then commit to repaying the loan in small, equal monthly amounts over a predetermined length of time. For many buyers, the mortgage process is an essential part of becoming a homeowner, even though it might be overwhelming …

Read More »The Entry Memorandum for Equitable Mortgages

The transfer of an interest in a specific piece of real estate with the goal of insuring repayment for loans taken out or to be taken out, payments on existing or future debts, or the fulfillment of agreements that might entail making payments is known as a mortgage. Among other …

Read More »Conventional Mortgage or Loan

What Is a Conventional Mortgage or Loan? A traditional mortgage is a loan that a buyer obtains from a private lender. Generally speaking, a conventional loan requires a better credit score to get approved than one from the Federal Housing Administration (FHA). Conventional loans are not provided by or guaranteed by a government body. These mortgages …

Read More »The Danish Guide to Mortgages

The Best Mortgage Calculator in Denmark It’s no secret that Denmark has some of Europe’s most breathtaking cities. The nation is colorful and dynamic, with beautiful coasts, landscapes, a thriving arts and culture scene, robust industries, and good healthcare systems. Whoa! In addition, the country routinely receives the highest rankings in the world for happiness.Therefore, …

Read More »Dutch mortgage interest rates are anticipated to rise in 2024.

The mortgage interest rate in the Netherlands rose significantly in 2022, whereas it was somewhat more stable the previous year. In 2023, mortgage interest rates ranged from 4% to 5%. A decrease in inflation and more stable mortgage interest rates encouraged purchasers to enter the market again. Looking ahead, what …

Read More »A Guide to New Zealand House Loans

For many, getting a mortgage is the magical ticket to becoming homeowners, and it has become an essential step. However, you might be wondering just what a mortgage is. Now let’s break it down! What is a mortgage, exactly? Essentially, a mortgage is a loan that you take out to buy real estate. It …

Read More »