A mortgage broker is a middleman who connects lenders and borrowers for mortgages; they do not fund the origination of the mortgages themselves.

A mortgage broker facilitates communication between borrowers and lenders and finds the ideal lender for the borrower’s demands regarding interest rates and financial status. They carry out the paperwork so the borrower is spared. Additionally, the mortgage broker obtains documentation from the borrower and forwards it to a mortgage lender for approval and underwriting. At closing, the broker receives a commission from the lender, the borrower, or both.

ESSENTIAL NOTES

- A mortgage broker is a type of financial middleman who helps home buyers find the best mortgage terms by connecting them with possible lenders.

- Throughout the loan term, a mortgage broker may help borrowers save a significant amount of money in addition to saving time and effort throughout the application process.

- Mortgage brokers can operate individually or as employees of a bigger mortgage brokerage firm. They are paid commissions, sometimes referred to as origination fees, based on the size of the loan.

- Obtaining a mortgage does not need working with a mortgage broker.

- But when looking for a home loan, a broker could be a smart option because certain lenders exclusively work with mortgage brokers.

How Mortgage Brokers Operate

In the real estate sector, a mortgage broker acts as a go-between for lenders and borrowers. A mortgage broker is in charge of qualifying a prospective borrower for a mortgage with many lenders while simultaneously presenting loan choices from those lenders for consideration, regardless of whether the borrower is refinancing or purchasing a new house.

Other obligations

The borrower provides the mortgage broker with the financial data required for the mortgage application procedure. This data includes job records, assets, debt, income, and credit information, among other things that lenders can utilize to determine a borrower’s capacity to obtain funding and make loan payments. It is thereafter forwarded to possible lenders by the mortgage broker.

The loan-to-value (LTV) ratio, the optimal loan type for the borrower, and the right loan size are all determined by the broker. They subsequently send the application to a lender for consideration. Through closing, the broker stays in constant contact with both the lender and the borrower.

After an agreement is reached, the mortgage lender loans the money in the mortgage broker’s name, and the mortgage broker gets paid a commission from the lender known as an origination fee in exchange for their services.1. In the closing statement, the borrower may be required to pay all or a portion of that charge. The mortgage broker receives payment only upon completion of the loan transaction.

When looking for a mortgage broker, borrowers should check internet reviews and get recommendations from friends, relatives, and real estate agents for one with the appropriate qualifications for their experience level. It’s critical to collaborate with someone you can trust and who offers quality service.

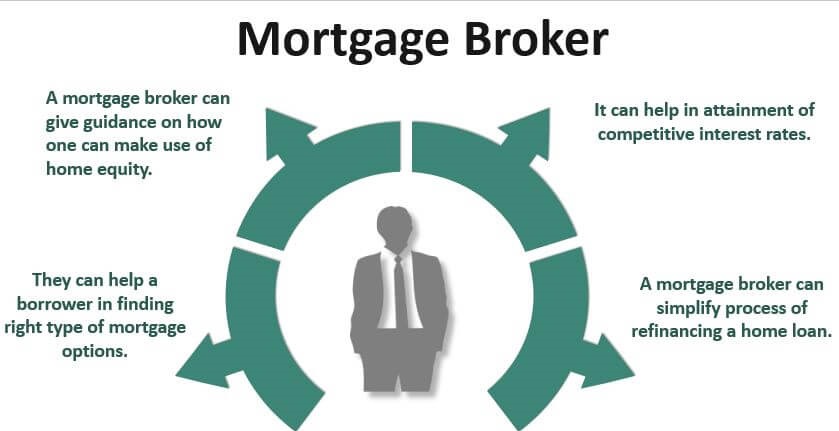

Benefits and Drawbacks of Mortgage Brokers

Benefits

- Mortgage brokers can help borrowers identify a range of possible lenders, saving them time and effort.

- They can assist borrowers in steering clear of dishonest or unsatisfactory lenders.

- Borrowers may not otherwise be able to access lenders without the help of the.

- Potential fee exemptions and improved lending rates can result in significant cost savings.

Drawbacks

- Some lenders you speak with directly might provide terms that are identical to or superior to those offered through a mortgage broker.

- The services of a mortgage broker are paid for with a fee.

- You might pass over a lender with favorable loan terms because some lenders don’t use mortgage brokers.

- Some mortgage brokers might steer you toward lenders who pay them more than ones that better suit your needs, for example, because they have conflicts of interest.

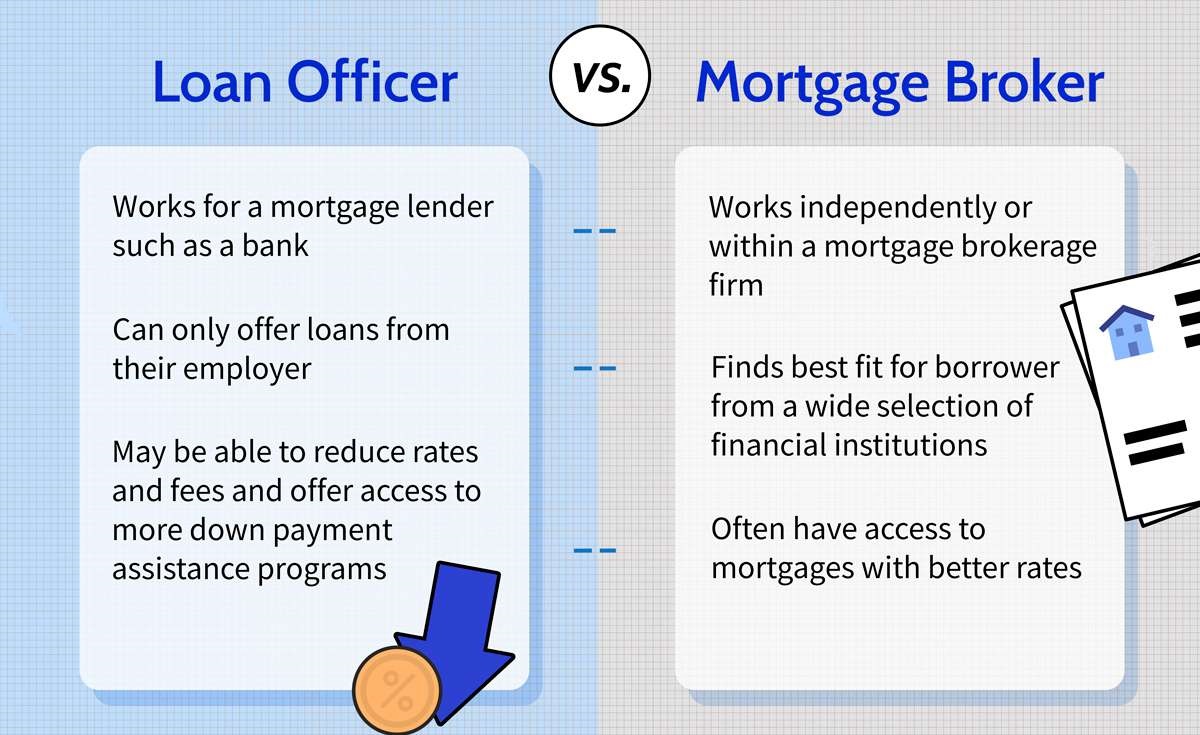

Loan officers against mortgage brokers

The first thing that many people do when they want to purchase or refinance a house is to get in touch with a loan officer at a nearby bank or credit union. Programs and mortgage rates from a single institution are provided by bank loan officers. In contrast, a mortgage broker searches various lenders for the best lending programs and/or the lowest mortgage rates on behalf of borrowers.

However, a mortgage broker’s ability to work with any number of lenders is constrained by the approval they receive from each lender. This implies that in order to get the greatest offer, borrowers are usually best served by performing some of their own research as well. A mortgage broker typically works with multiple clients concurrently and is paid only when a transaction closes. This incentivizes mortgage brokers to engage in more personalized engagement with each borrower. A mortgage broker applies to other lenders if a loan that was arranged through their efforts is turned down.

Because they are working with multiple borrowers at once, a large bank’s loan officer may make a borrower wait a long time. The bank and loan officer take no further action if a loan that originated through them is denied. Certain lenders only collaborate with mortgage brokers, granting borrowers access to loans that they would not have otherwise. Furthermore, mortgage brokers have the ability to persuade lenders to waive origination, application, appraisal, and other fees. Large banks do not waive fees and only collaborate with loan officials.

Can I Apply for a Mortgage Without Using a Mortgage Broker?

You certainly can. Nevertheless, obtaining a house loan is a difficult task, and a mortgage broker can assist you with the legwork. Their primary goal is to connect lenders and borrowers.

Do Conflicts of Interest Arise for Mortgage Brokers?

Maybe. A basic conflict of interest exists since mortgage brokers typically receive compensation when they refer lenders. Furthermore, they could refer consumers to lenders who pay them more than others—lenders who might be a better fit for the borrower. This is not how loan officers who receive salary as opposed to commissions are incentivized.

What Makes a Mortgage Broker Your Best Choice?

When looking for a mortgage, mortgage brokers might be a suitable option for you because they can connect you with a variety of lenders that you might not otherwise be aware of. They can assist you with your loan application as well as the copious amounts of paperwork you’ll need to submit. Furthermore, some lenders exclusively collaborate with mortgage brokers.

In summary

One kind of broker that helps home loan applicants find the lenders who can best meet their demands is a mortgage broker. For a charge, they can, in relation to the mortgage procedure, save borrowers a great deal of time, effort, and possibly money. When you choose to work with a mortgage broker instead of obtaining a mortgage on your own, make sure you have done the necessary amount of research about the fees, reputation, services, and advantages of mortgage brokers.